eFax How-Tos

How to Fax IRS Form 2553 Online: A Guide for Small Businesses

If you’re a small business owner looking to set up an S corporation, you’ll need to fill out form 2553 and send it to the IRS. As you navigate tax season, here’s an easy-to-follow guide for faxing Form 2553 to the IRS.

What is IRS Form 2553?

IRS Form 2553 is an official document the Internal Revenue Service (IRS) uses to register small businesses as S Corporations rather than the standard C Corporations. Signing the form allows a company to become a pass-through entity, gain relevant tax benefits and save money on their annual tax bills.

Registering as an S Corporation enables significant tax benefits, including not paying corporate tax. Additionally, the organization’s profits and losses are passed to shareholders on their individual tax returns, who are subsequently taxed on those profits rather than their income tax rates.

IRS Form 2553 also helps businesses avoid paying double taxation. It should be submitted up to two months and 15 days after the start of the applicable tax year. For newly formed organizations, the tax year begins on the day they are formed.

Eligibility to Fax IRS Form 2553

Organizations aiming to file IRS Form 2553 to register as an S Corporation must comply with specific criteria. The company must be a domestic corporation, use the calendar year as its tax year and not be an investment company. There are also criteria, such as companies only being allowed up to 100 shareholders, who must only be allowable shareholders, which may include certain trusts, estates, and individuals. The organization also must not have non-resident alien shareholders.

How to Fax IRS Form 2553 Securely?

Many companies find it confusing to understand where to send IRS Form 2553 and find the right IRS Form 2553 fax number. Organizations have two options: either mail the form to their local IRS office at the Department of the Treasury or send it to the appropriate fax number for Form 2553.

The relevant IRS fax number for form 2553 depends on the state in which organizations are located. The options are as following:

- Organizations with their principal office in Connecticut, Delaware, District of Columbia, Florida, Indiana, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Vermont, Virginia, or West Virginia should fax their Form 2553 to 855-270-4081.

- Corporations in Georgia, Illinois, Kentucky, Michigan, Tennessee or Wisconsin should fax Form 2553 to 855-887-7734.

- Companies with primary businesses in Alabama, Alaska, Arkansas, California, Colorado, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington or Wyoming should fax their Form 2553 to 855-214-7520.

- Organizations in Cincinnati should fax their Form to 855-270-4081.

- Businesses with offices in Ogden should file their form 2553 by faxing 855-214-7520.

Organizations should expect to hear a response from the IRS within 60 days of sending their form to the 2553 fax number.

Make Filing Form 2553 Easy Via Online Fax

Filing Form 2553 can seem daunting, but with eFax, it doesn’t have to be. Now that you know how to fax online with eFax, upgrade your tax status with the IRS today and discover how eFax makes it simple to file your Form 2553 with features like:

Secure Faxing: eFax enables organizations to share important documents securely. All online faxes are protected by encryption and the Transport Layer Security protocol and comply with leading industry regulations, such as the Health Insurance Portability and Accountability Act. The eFax service also adds legally binding digital signatures to all faxes.

Sharing and Storage: Sharing large documents via online messaging services like email and instant chat can be challenging. But eFax enables companies to share large files up to 3GB via fax. eFax also provides unlimited free cloud storage, allowing users to securely store all their critical documents in the cloud.

Ease of Use: eFax makes it easy to find any fax in seconds with its simple searching, sorting and tagging features. The eFax mobile app also makes it easy to send and receive fax messages on the go from any device. While eFax’s provision of local and toll-free fax numbers makes it easier than ever for clients and customers to reach organizations.

5 Easy Steps to Fax Form 2553

Is It Possible To Fax Form 2553 to the Internal Revenue Service (IRS)?

Yes, you can fax Form 2553 to the IRS. When faxing your tax form, ensure your documents are in order, you’ve completed all necessary paperwork, and have attached any required forms. Once your fax has been sent, keep track of the form in your corporation’s official records for business purposes.

A Guide to File and Fax Form 2553 to IRS for Small Businesses

An Introduction to Form 2553

Form 2553 is an IRS form that business owners must submit to be taxed as an S corporation. The form also notifies the IRS of the name and details of the business and the intended effective election date. Form 2553 must be signed by all shareholders and filed within two months and 15 days after the beginning of the tax year in which the S corp election is intended to take effect.

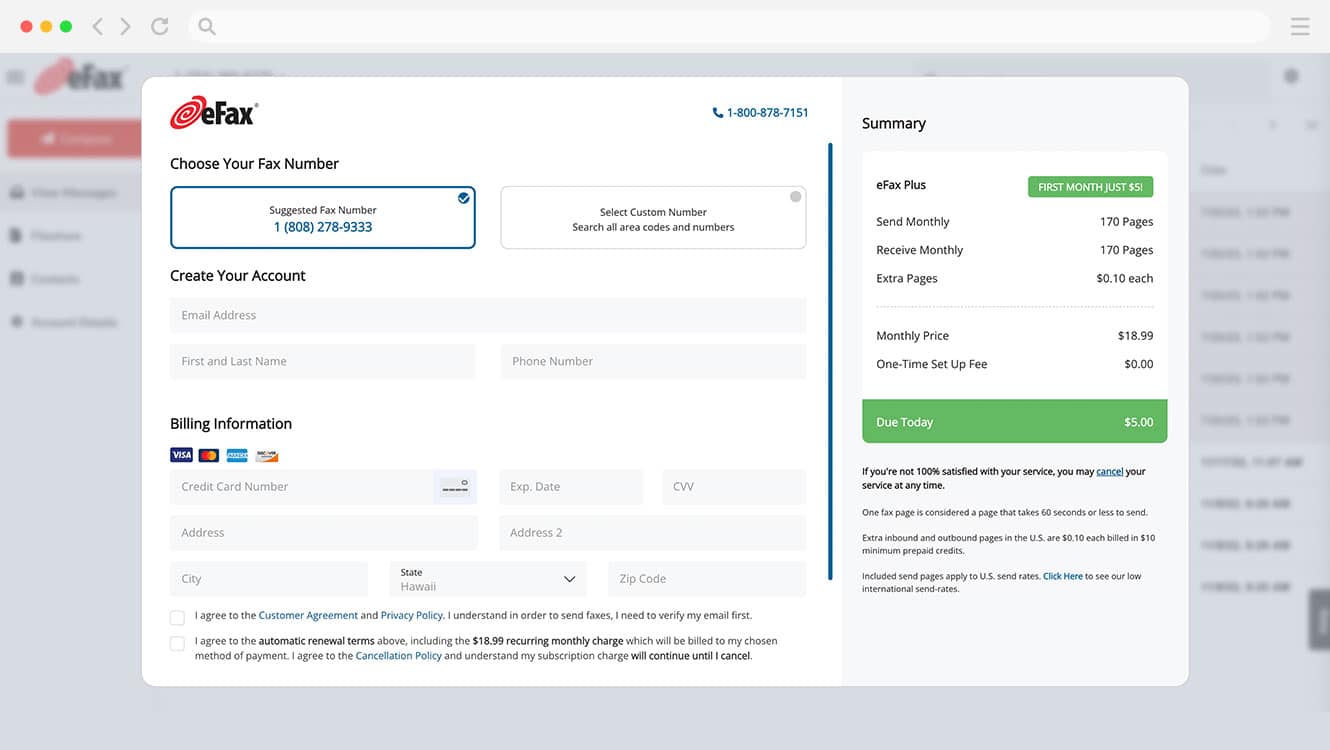

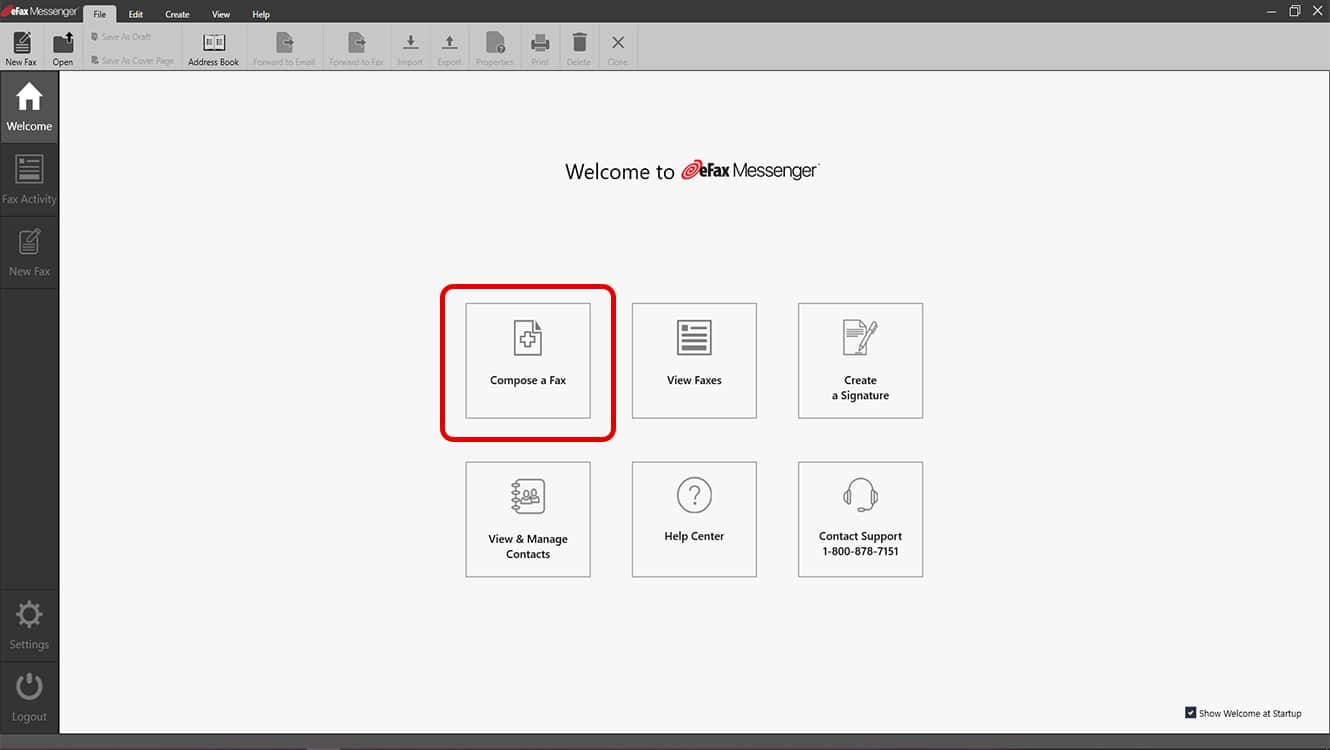

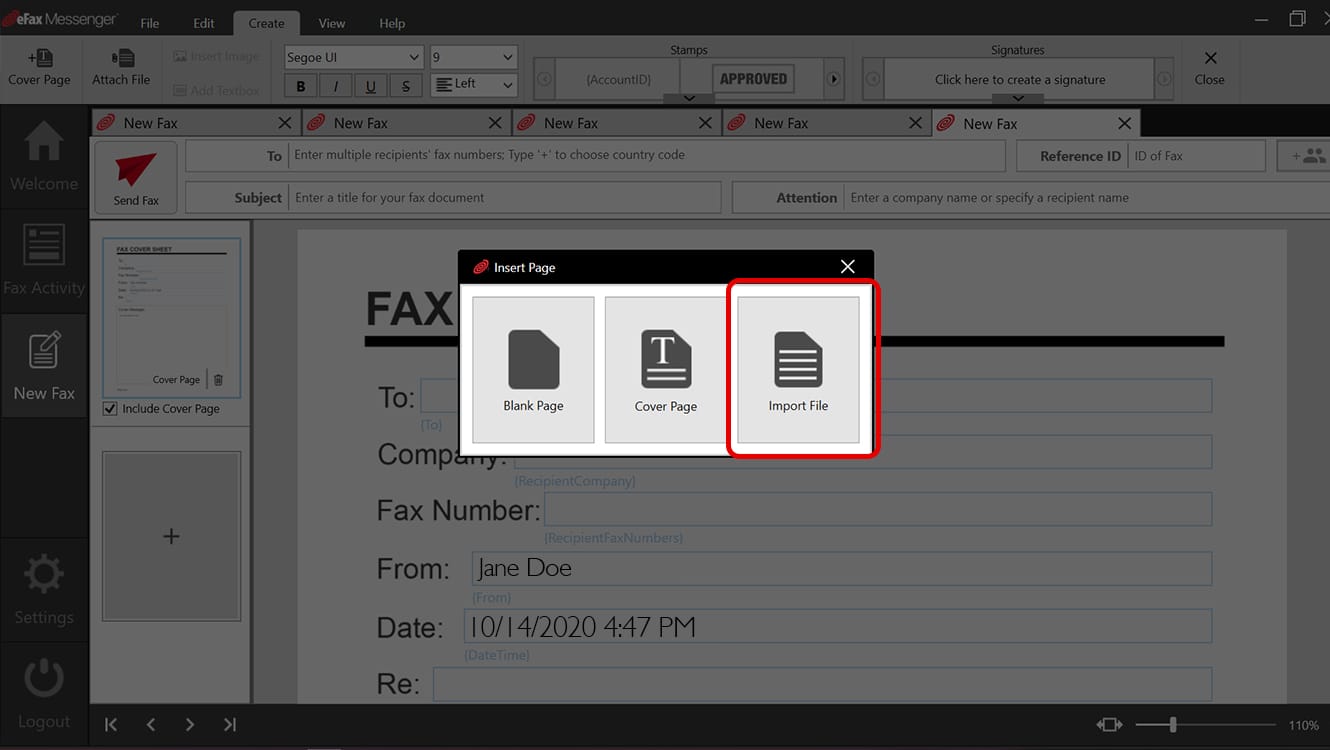

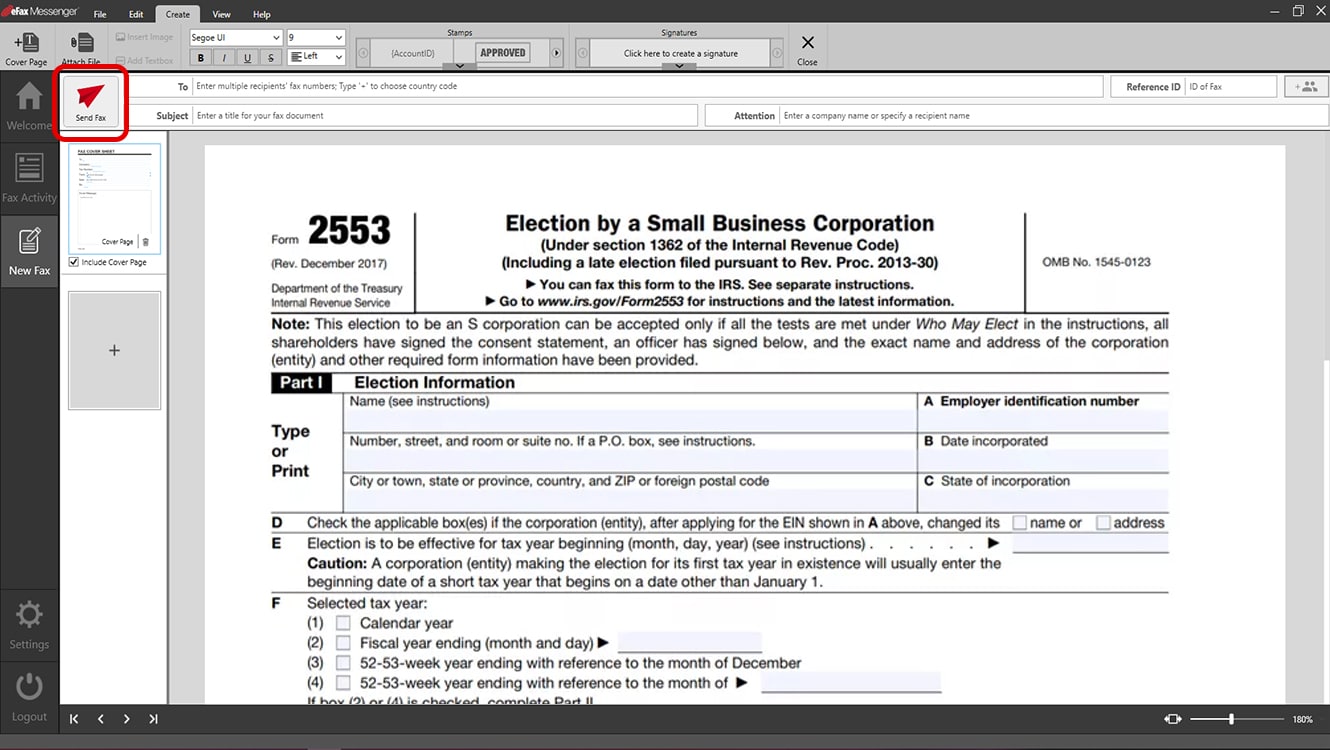

In order to submit form 2553 in a timely manner for your small business, it’s best to use a dependable, easy-to-use online faxing software like eFax. By using eFax, you can submit your tax documents online from your own computer.

To learn more, see About Form 2553, Election by a Small Business Corporation on the IRS website.

Using eFax to Send Tax Documents

eFax is a great tool to fax tax documents to the IRS. eFax is a safe way to send sensitive documents privately with the use of a toll free or international fax number. You and your recipients can even add a digital signature to every document, so you can ensure your IRS documents are submitted and approved before the deadline.

The eFax Difference

eFax is flexible and affordable, making it highly beneficial for small businesses. Forget about bulky paperwork, maintaining physical records, or trying to track down a fax center in your area. With eFax, you can send all the tax documents you need to support your business by subscribing to the affordable monthly subscription.

Because eFax offers a mobile app and a desktop platform, you have the flexibility to fax your tax documents when and where you need to.

eFax offers these benefits to faxing in your documents instead of filing or faxing them manually:

- eFax hosts your documents in free cloud storage, so you can easily find important tax files you’ve already sent.

- With eFax’s tagging and searching function, you can quickly pull up documents you need to reference.

- After you submit tax documents with eFax, you’ll get a delivery confirmation. Your recipient will also receive a notification that they have a fax waiting for them.

- You can attach multiple files to one fax, simplifying the tax submission process.

Faxing Specific Types of Documents

Easily learn how to fax various types of documents by following our step-by-step guides. Whether you’re working with PDFs, JPEGs, or cover sheets, we’ve got you covered.

Send and Receive Faxes in Minutes

Fax IRS Tax Form 2553 Online from Anywhere in Minutes with eFax

Filing Form 2553 can seem daunting, but with eFax, it doesn’t have to be. Now that you know how to fax online with eFax, upgrade your tax status with the IRS today.

eFax makes filing taxes easy and fast for small business owners. You can fax from anywhere in minutes and return to doing what you do best — running your business. So don’t wait any longer — get started with eFax today and simplify tax filing.

FAQs Related to Faxing IRS Form 2553

You can fax form 2553 to the IRS using the fax number for your state. See this IRS table for the exact fax numbers.

When faxing, include a cover sheet with your name, phone number, and Employer Identification Number. If your filing is accepted, the IRS will send you a confirmation letter within 60 days.

Form 2553, officially titled “Election to Be an S Corporation,” is a United States Internal Revenue Service (IRS) tax form used by eligible corporations to elect to be treated as an S corporation for tax purposes. S corporation designation can be beneficial for small businesses that want to avoid double taxation on their income.

It’s important to fill out form 2553 completely and accurately for your small business. To fill out form 2553, follow the steps outlined in this IRS guide: Instructions for Form 2553.

Either way works, but sending Form 2553 by fax is generally faster because it doesn’t require USPS shipping time. With eFax, your forms send in minutes and you will get a delivery confirmation for peace of mind. If your fax fails, eFax will retry until it succeeds. If the fax number for the recipient is incorrect, you will get a fax failure notification.

You can fax Form 2553 to the IRS at 855-887-7734 or 855-214-7520.

Yes! You can use eFax to quickly and painlessly fax your tax forms, including form 2553. Sign up and start faxing today!

C Corporations are standard organizations according to the IRS rules. An S Corporation has special tax status under the IRS rules, which allows tax advantages. The business structure names come from the revenue code they are taxed under—C corporations are filed under Subchapter C, and S Corporations are filed under Subchapter S. Organizations apply to become an S Corporation by filing an IRS Form 2553.